Zero Based Budgeting made easy with Bokari

Maybe the most confusing thing one has to do as an adult is handling money; saving, investing, paying for stuff we need, paying for stuff we want, paying for stuff we neither want nor need but have to pay for anyway… you know the drill. This can be very stressful and anxiety inducing.

Sometimes, for handling stressful and anxiety inducing activities we can’t avoid, having some structure can help. One way of structuring the expense of money is using a particular take at Zero-based budgeting oriented at handling personal expenses.

The personal finance Zero-based Budget

Very basically, a Zero-based Budget in the context of personal finance is:

A spending plan where you assign every dollar you make to a category so that your planned expenses (including your savings goals) are equal to your income.

Now this can be a bit overwhelming and quite hard to stick with, as the people from Experian say. Not to mention that doing the calculation can be annoying.

Bokari as a Zero-based Budget assistant

From the moment I learned about this concept, I wanted badly to introduce it into my habits. Since I couldn’t find any app or tool that would provide me with the functionalities I wanted, I created Bokari (which means accountant in Danish, if you were wondering).

Bokari is a quite simple web application that allows you to create and dynamically edit a Zero-based Budget.

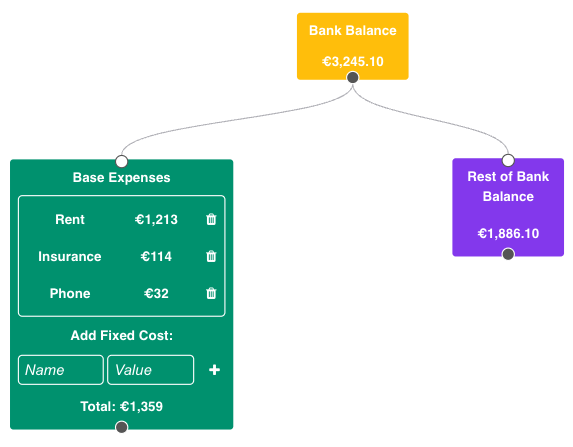

The idea is as simple as the concept; you have a Root Node that represents the initial budget (be that your income or your bank balance) and then a bunch of other Nodes you can use to assign parts of this budget to specific expenses or savings. Bokari always makes sure that all of the budget is assigned somewhere and lets you set expenses as either fixed amounts or a proportion of the budget. But it’s not just that; because of its directed graph nature, it just lets you recursively create Zero-based Budgets from each of your new nodes!

Setting up your budget with Bokari

A good way of starting with Zero-based Budgeting is by starting off from your income and building from there. In Bokari, you would use a Root Node for that:

Now you most likely have some fixed expenses that never change and are somehow related; for that, you can then create a Fixed Group Node and connect it to your Root Node!

As we mentioned above, the idea of Zero-based Budgeting is that there is no unassigned portion of the budget. Every time there is some money unassigned, Bokari will automatically create a

As we mentioned above, the idea of Zero-based Budgeting is that there is no unassigned portion of the budget. Every time there is some money unassigned, Bokari will automatically create a Relative Node, which will have the left over budget of its parent (in this case the Root Node).

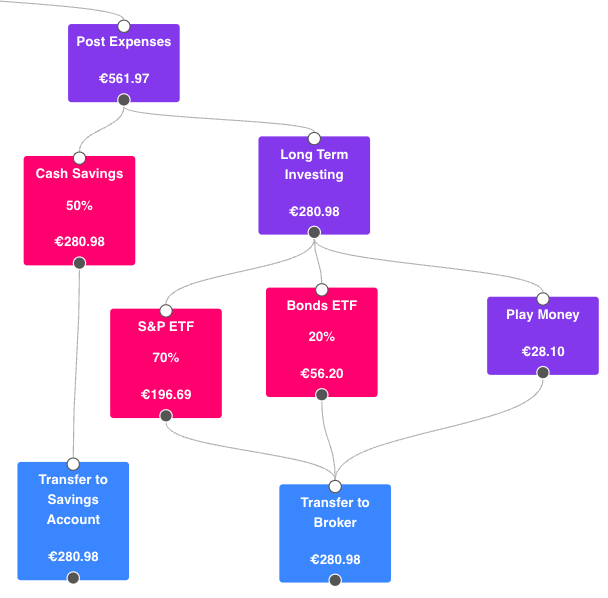

Finally, you might want to assign certain percentages of a budget to different categories; this comes in really handy when assigning parts of a budget to investing. Bokari allows you to do this very simply by using Proportional Nodes; look:

As you may have noticed, you can also re-group nodes into

As you may have noticed, you can also re-group nodes into Aggregator Nodes so it’s easier to know how much you need to transfer to, for example, your broker or savings account.

Using Bokari after the initial setup

Of course, the real value of this is doing it month after month and make a habit out of it. The cool thing about Bokari is that you can just click Save and it will remember your current budget graph (be mindful that it just uses the local storage and the only place where it will be saved is your browser, as long as you don’t clear it). This means that next month you can come back, update any expenses that might have changed (like credit card costs) or your budget and it will automatically recalculate anything!

If one month you want to change the proportion of money you assign to investing, or remove it altogether (or whatever, really), you can just do it with a bunch of clicks!

Conclusion

This web-app is the result of a personal project I worked on because I couldn’t find an existing solution (and for fun too!); that means that I stopped at the point where it covered my current needs. Nevertheless, it is an open source project you can find in my GitHub and everyone is free to open Issues or Pull Requests; any help is always appreciated!

There might be another post in the future where I talk extensively about how it works inside for the tech-savvy people who may be interested!

Thank you very much for reading this far! Happy budgeting! I’ll leave you with a jewel that is related and cannot be left out when talking about budgeting: The Office - Surplus - Explain it like I’m 8.